In this Mentor Local Buzz Issue…

🌤️ Weather: Partly Sunny - Temps 28-30

🎉 Events: 50+ Live Events. Direct Link to Mentor Live Events

📰 Local News: 📞📧 We’ve Updated Our Contact Information—Reach Out

📰 Proposed Ban on Short-Term Rentals in Mentor Sparks Ongoing Discussion

📰 New Leadership at BBB Cleveland: Pamela Anson Steps Into Top Role

👨👩👧👦 Special Section: Real Estate: 📊 Will Mortgage Rates Fall in 2025? Exploring Past Trends and Future Predictions

🏘️ Featured New Home Listings for Sale in Mentor, Ohio (44060)

🏀 Sports: 🏈 Philadelphia Dominates: Eagles Claim Second Super Bowl in Blowout Over Chiefs

🤔 Trivia Question

🤣 Something Funny

Partly Sunny - Temps 28-30

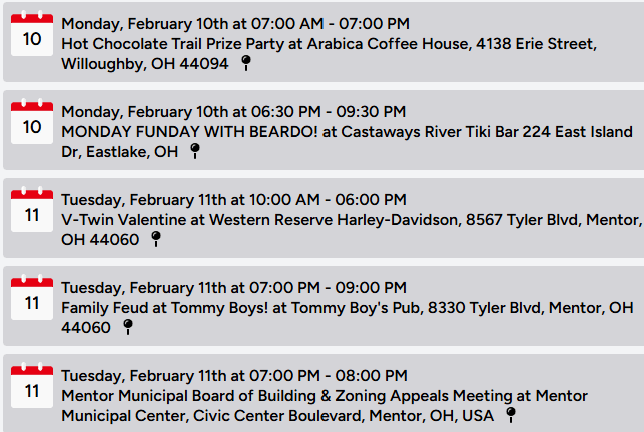

👉 Mentor Live Events 👈

Feb 10-11

Complete list of events and all the details in the link above “Mentor Live Events”. New Events Added Daily.

See All the Upcoming Events Here at:

Mentor Live Events!

50+ Event Dates

📞📧 We’ve Updated Our Contact Information—Reach Out Anytime!

Mentor Local Buzz Has Updated Contact Information

We’re excited to share our new contact details with you! Whether you have a story idea, a question, would like to advertise, or just want to get in touch, it’s now easier than ever.

Phone Number: 440-256-6115

Email: [email protected]

Website: www.mentorlocalbuzz.com

Newsletter Sign-Up: newsletter.mentorlocalbuzz.com

We look forward to hearing from you!

📰 Proposed Ban on Short-Term Rentals in Mentor Sparks Ongoing Discussion

Mentor City Council Weighs Short-Term Rental Rules

Mentor City Council is reviewing how to regulate short-term rentals, which are not recognized in the city’s planning and zoning code. Discussions began in early 2024 after officials discovered several unregulated short-term rentals operating without permits.

A proposed ordinance to ban short-term rentals in all zoning districts was introduced in October 2024 but has been tabled following public feedback. Residents urged council to consider regulation rather than an outright ban.

At a recent work session, city administrators presented examples of how other Ohio communities regulate and enforce short-term rental programs. Council President Sean Blake stressed the importance of understanding how short-term rentals could affect Mentor’s neighborhoods, where most homes are owner-occupied.

Mentor’s popularity with visitors, particularly birdwatchers and ecotourists, has contributed to growing interest in short-term rentals. While acknowledging their appeal, city officials also note the challenges they pose. Council is expected to provide further updates in the coming weeks as discussions continue.

📰 New Leadership at BBB Cleveland: Pamela Anson Steps Into Top Role

Pamela Anson - BBB

BBB Cleveland proudly announces the appointment of Pamela (Pam) Anson as its new President and CEO. A dedicated leader with over a decade of experience at BBB Cleveland, Anson has been a driving force within the organization.

Under her leadership, the organization looks forward to continued growth, innovation, and an expanded impact on the community. Anson is committed to upholding BBB’s legacy of trust and integrity while empowering businesses and consumers with the tools they need to succeed.

BBB Cleveland is excited to embark on this new chapter and thrive under her guidance.

Source: instagram.com/bbbcleveland

📊 Will Mortgage Rates Fall in 2025? Exploring Past Trends and Future Predictions

In recent years, homebuyers have faced a tough combination of rising home prices and increasing mortgage rates, making affordability a significant challenge. As we step into 2025, many are wondering if mortgage rates will finally ease or if they’ll continue to climb. While predicting the future of mortgage rates is tricky, taking a look at their historical trends can help provide some perspective—and maybe even a bit of optimism.

The Current Mortgage Rate Landscape

Following the Federal Reserve's decision to hold rates steady in January, 30-year fixed mortgage rates remain in the high 6% range. While this offers little immediate relief, many experts are hopeful for potential rate cuts later in 2025. These anticipated reductions could spark renewed interest among buyers and homeowners eager for more favorable borrowing conditions.

It’s worth noting that published average mortgage rates are benchmarks. Borrowers with strong credit scores and solid financial profiles can often secure lower rates than the industry average.

A Look Back at Mortgage Rate History

Mortgage rates are still relatively low when viewed through a historical lens. Since Freddie Mac began tracking in 1971, the average 30-year fixed mortgage rate has been around 7.73%. Rates reached an all-time high of 16.63% in 1981 and hit record lows of 2.65% in January 2021 during the COVID-19 pandemic.

The last few years have seen significant fluctuations. Rates fell below 3% in 2020 and 2021 due to Federal Reserve actions aimed at stabilizing the economy during the pandemic. However, as inflation surged in 2022, rates climbed dramatically, peaking at 7.08% in October of that year—the highest in two decades.

In 2023, rates fluctuated but remained high, largely influenced by ongoing efforts by the Federal Reserve to combat inflation. Although 2024 saw three rate cuts, their impact on mortgage rates was modest. Still, optimism is growing that further rate reductions in 2025 could help ease borrowing costs.

Will Mortgage Rates Fall in 2025?

While it’s impossible to predict mortgage rates with complete certainty, many experts expect them to decline gradually over the next year. The Mortgage Bankers Association and Wells Fargo forecast that 30-year fixed mortgage rates could drop to between 5.5% and 6.0% by the end of 2025.

Ultimately, timing the market may not be the best strategy for prospective buyers. It’s more important to focus on personal readiness—purchasing when you’re financially prepared and can afford the home you want. Remember, mortgage rates are not permanent. If they fall significantly in the future, refinancing is always an option.

What Influences Your Mortgage Rate?

Several factors impact the rate borrowers receive, including credit score, down payment, loan type, loan term, and loan amount. Here’s a quick breakdown:

Credit Score: Higher scores typically qualify for better rates.

Down Payment: Larger down payments can reduce interest rates and eliminate private mortgage insurance (PMI).

Loan Type: Government-backed loans like FHA or VA loans may offer competitive rates, especially for borrowers with lower credit scores.

Loan Term: 15-year mortgages generally have lower rates than 30-year loans but come with higher monthly payments.

Loan Amount: Rates for smaller or jumbo loans may differ from standard loans.

Discount Points: Borrowers can pay upfront for discount points to lower their interest rate over the life of the loan.

The Bigger Picture

Historical mortgage rate trends reveal that rates rise and fall with economic conditions. While current rates may feel high compared to the record lows of 2021, they are still relatively moderate in the grand historical scheme. As the market continues to stabilize, homebuyers can remain hopeful for a more favorable rate environment in the near future.

Read the Full Article at themortgagereports.com

🏘️ Featured New Home Listings for Sale in Mentor, Ohio (44060)

9123 Dove Ln., Mentor, OH. 44060

4 Beds, 3.5 Baths, 2,400 Sqft. 4,299 Sqft. Lot

Sale Price $525,000

Listed by: Anthony Roncalli Brokered by Homesmart Real Estate Momentum Llc

Link to Property Listing

5951 Center St., Mentor, OH 44060

4 Beds, 3.5 Baths, 3,191 Sqft., 0.75 Acre Lot

Sale Price $439,900

Listed by: Laura Mokwa Brokered by McDowell Real Estate

Link to Property Listing

9701 Hoose Rd., Mentor, OH 44060

3 Beds, 2.5 Baths, 1,656 Sqft., 0.51 Acre Lot

Sale Price $349,900

Listed by: Asa Cox Brokered by CENTURY 21 Asa Cox Homes

Link to Property Listing

7443 Presley Ave., Mentor, OH 44060

3 Beds, 2 Baths, 1,355 Sqft. 7,653 Sqft. Lot

Sale Price $279,900

Listed by: Beth Kitchen Brokered by Homesmart Real Estate Momentum Llc

Link to Property Listing

5034 Glenn Lodge Rd., Mentor, OH 44060

3 Beds, 1 Baths, 992 Sqft. 6,482 Sqft. Lot

Sale Price $179,900

Listed by: Michael Kaim, Agent Brokered by Real Brokerage Technologies, Inc.

Link to Property Listing

Link to Other Listings in Zip Code 44060

Newsletter cut short in your email? If so,

🏈 Philadelphia Dominates: Eagles Claim Second Super Bowl in Blowout Over Chiefs

The Philadelphia Eagles crushed the Kansas City Chiefs 40-22 on Sunday, claiming their second Super Bowl title and ending Kansas City’s hopes for a three-peat. Philadelphia’s defense overwhelmed the defending champions, with Cooper DeJean’s pick-six and relentless pressure from Josh Sweat keeping Patrick Mahomes and Travis Kelce in check.

Quarterback Jalen Hurts led the charge, throwing for 221 yards, two touchdowns, and rushing for another on a signature "tush push." Saquon Barkley had a modest 57 yards but broke Terrell Davis’ all-time single-season rushing record.

The Eagles jumped out to a 24-0 first-half lead, capitalizing on two interceptions of Mahomes, including DeJean’s 38-yard touchdown return. Hurts later connected with DeVonta Smith for a 46-yard score, extending the Eagles’ dominance. Meanwhile, Mahomes struggled under pressure, taking six sacks, a career-high in postseason play.

Even with Taylor Swift in attendance, the Chiefs couldn’t find their rhythm. Mahomes threw three late touchdowns, but it was too little, too late.

For Eagles head coach Nick Sirianni, the victory silenced critics and secured his first championship. The Eagles’ defense, featuring eight new starters, ensured Mahomes had no chance to pull off another comeback.

The Chiefs aimed to become the first NFL team to win three consecutive Super Bowls in the modern era, but Philadelphia had other plans.

Read the Full Article at espn.com

🤣 Something Funny 🤣

Funny at first … but not really. Tighten those lug nuts!